Cost of Common Equity Calculator

To calculate the Cost of Common Equity (Ke), divide the expected dividend by the current stock price and add the growth rate of dividends. This formula helps estimate the return required by shareholders.

To calculate the Cost of Common Equity (Ke), divide the expected dividend by the current stock price and add the growth rate of dividends. This formula helps estimate the return required by shareholders.

The Cost of Common Equity Calculator is a financial tool used to estimate the return that shareholders expect from their investment in a company. This calculation is crucial for businesses aiming to evaluate their financing costs and determine the equity portion of their capital structure.

The cost of equity represents the compensation the market demands in exchange for owning the asset and bearing its associated risks. It’s necessary for calculating the Weighted Average Cost of Capital (WACC), comparing the cost of debt versus equity, and making informed financial decisions.

The formula for Cost of Common Equity (Ke) is:

| Variable | Description |

|---|---|

| Cost of Common Equity | |

| Expected Dividend per Share | |

| Current Stock Price | |

| Dividend Growth Rate |

Example 1:

If the expected dividend per share is $2, the current stock price is $40, and the dividend growth rate is 5%, calculate the cost of common equity.

| Step | Calculation |

|---|---|

| 1. | |

| 2. | |

| 3. |

Answer: 10%

Example 2:

For a stock with an expected dividend of $3 per share, a current stock price of $50, and a growth rate of 6%:

| Step | Calculation |

|---|---|

| 1. | |

| 2. | |

| 3. |

Answer: 12%

The Cost of Common Equity Calculator is a unique tool that is usually used by investors and financial analysts. It functions to calculate the return required on a company’s common stock. This measure, known as the cost of equity, is essential in assessing a company’s overall cost of capital and is crucial for making informed investment decisions.

In addition to that, this calculator uses methods like the Dividend Growth Model or CAPM (Capital Asset Pricing Model) to estimate the cost of equity, factoring in elements like dividend growth, market risk, and return rates.

Chiefly, in corporate finance, understanding the cost of common equity is vital for calculating the Weighted Average Cost of Capital (WACC), which helps evaluate investment risks and returns. This tool also assists companies in balancing their funding sources, whether through equity or debt, by providing a clearer picture of financial obligations and growth potential.

Lastly, the Cost of Common Equity Calculator is an invaluable asset for those analyzing capital costs, enabling both investors and companies to assess financial strategies effectively.

![10th Power Calculator [Power Of 10 Calculator 2025] 1 Area calculators for precise measurement and conversion of various shapes and surfaces for accurate space planning and construction projects.](https://areacalculators.com/wp-content/uploads/2025/07/10th-power-calculator-768x432.png)

To calculate the 10th power of a number, multiply the base number by itself ten times or raise it to the exponent of 10. The 10th Power Calculator allows you to find the result of raising a number to the power of 10 effortlessly. This tool is ideal for simplifying mathematical problems involving large numbers,…

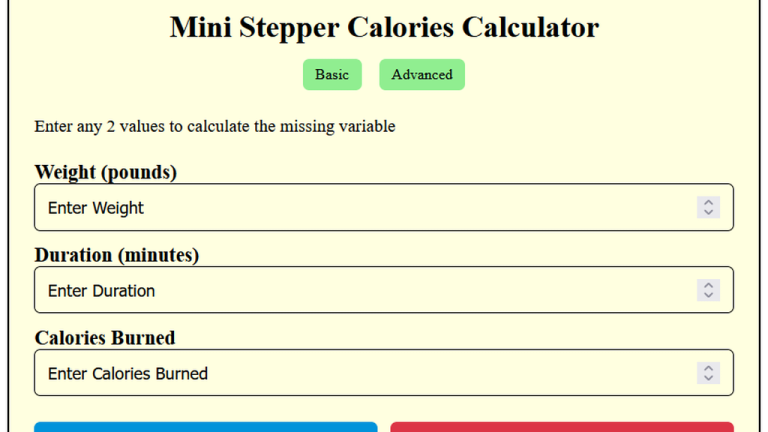

To calculate calories burned on a mini stepper, multiply the MET value by your weight (in kg), divide by 200 after multiplying by 3.5, and then multiply by the exercise duration in minutes. The Mini Stepper Calories Calculator estimates the number of calories that get burned during a workout session using a mini stepper. This…

12 / 100 SEO Score Enter the values to use our basic and advanced Mass Per Unit Area Calculator that let’s you know that how much material is spread over a certain area. Furthermore, read the formula and solved examples below to have better understanding. Formula: The formula is: MPA=mA\text{MPA} = \frac{m}{A} Variables Variable Meaning…

![mEq Calculator [ Milliequivalents, Milligrams, Milliliters ] 5 Mg element area calculator for substance molar weight and valence calculation useful for chemical analysis and scientific research.](https://areacalculators.com/wp-content/uploads/2025/07/meq-calculator-768x432.png)

To calculate milliequivalents (mEq), multiply the amount in milligrams (mg) by the valence (V), then divide by the molecular weight (MW). The mEq Calculator is a practical tool for converting milligrams to milliequivalents (mEq). It is widely used in medical, chemical, and nutritional fields for determining the equivalent concentrations of electrolytes, such as potassium, sodium,…

To convert pH to mol/L, use the formula where the hydrogen ion concentration [H+][H⁺] equals 10−pH10^{-\text{pH}}. The pH to Mol/L Calculator simplifies the process of determining hydrogen ion concentration ([H+][H⁺]) from a given pH value. This is essential in chemistry, biology, and environmental science for analyzing the acidity or basicity of solutions. By providing precise and…

To determine the price per pound, divide the total price by the total weight in pounds. The Price Per Pound Calculator is ideally suited for calculating the cost of items on a per-pound basis. It is useful for budgeting, shopping, and price comparisons. This calculation is commonly applied to food items, metals, and other materials…