Commission Draw Calculator

To calculate the commission draw (CD), multiply the total commission earned (C) by the rate (R), then subtract the draw amount (D) from the result. This gives you the remaining commission after the draw.

To calculate the commission draw (CD), multiply the total commission earned (C) by the rate (R), then subtract the draw amount (D) from the result. This gives you the remaining commission after the draw.

The commission draw calculator is a useful tool for the salespeople who are working on a draw against commission plan. A draw is an advance payment given to employees, and it’s later deducted from their commission earnings. This calculator helps determine how much commission is left after the draw is subtracted.

So, to have the understanding of this structure is important to ensure you’re receiving the correct earnings, especially when working on a commission-based pay plan.

| Variable | Description |

|---|---|

| C | Total Commission Earned |

| R | Commission Rate |

| D | Draw Amount |

Example 1:

| Step | Calculation |

|---|---|

| Determine values | C = $5,000, R = 12%, D = $400 |

| Multiply C by R | $5,000 × 0.12 = $600 |

| Subtract draw amount D | $600 – $400 = $200 |

| Result | $200 |

Answer: The remaining commission after the draw is $200.

Example 2:

| Step | Calculation |

|---|---|

| Determine values | C = $8,000, R = 10%, D = $500 |

| Multiply C by R | $8,000 × 0.10 = $800 |

| Subtract draw amount D | $800 – $500 = $300 |

| Result | $300 |

Answer: The remaining commission after the draw is $300.

A commission draw calculator is virtually a helping hand for employees or salespeople to calculate their earnings when they receive a draw against future commissions. Basically, a draw is an advance on expected commissions that is typically used in sales roles to ensure a minimum income.

The draw is repaid through earned commissions. To calculate your commission, you’ll subtract the draw from the commission you’ve earned. If your earned commission exceeds the draw, you take home the excess.

So, when calculating commissions, the percentage or flat-rate structure is applied based on sales performance. For example, if a 12% commission rate is applied to sales of $10,000, the commission earned would be $1,200. If you received a $500 draw, your final commission would be $700 ($1,200 minus the $500 draw).

Accordingly, commission structures can vary. Some involve tiered systems where higher sales earn higher commission rates. Excel-based calculators are commonly used for this, offering easy input of sales figures, commission percentages, and draw amounts to quickly determine payouts.

In summary, a commission draw calculator helps employees understand their compensation under this structure. It ensures that both employers and employees can manage pay expectations efficiently.

To find the date 61 days from today, add 61 days to the current date. 61 Days From Today Calculator Today’s Date Date 61 Days From Today Calculate Reset Predicting 61 Days From Today can be a simple way to make plans for many things. These may include future events, deadlines, or any other specific date….

Divide the original number of shares by the split ratio to determine the new number of shares post-reverse stock split. The Reverse Stock Split Calculator is a tool designed to help investors calculate the new share quantity and price after a reverse stock split. Formula: NP = OP / SP Variable Definition Units NP New…

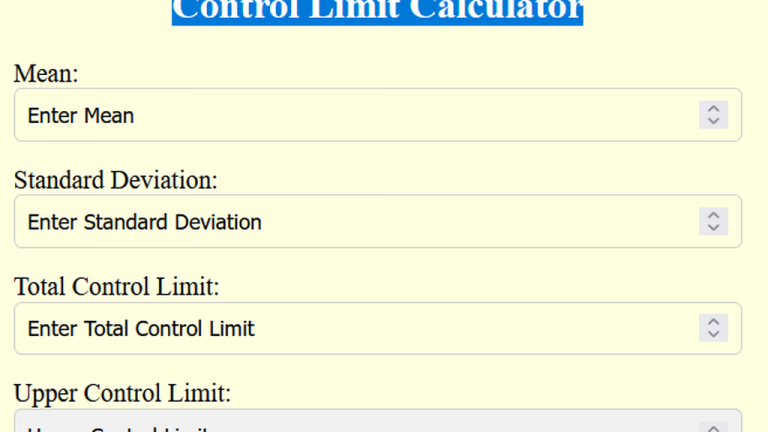

To determine control limits, subtract or add the product of a factor, the mean, and standard deviation to the process mean for lower (LCL) and upper (UCL) control limits. The Control Limit Calculator calculates the upper control limit (UCL) and lower control limit (LCL) for statistical process control charts. These limits help monitor process stability…

To calculate 730 days from today, simply add 730 days to the current date. 730 Days From Today Calculator Enter a date to find the date 730 days later. Today’s Date Date 730 Days From Today Calculate Reset The 730 Days From Today Calculator empowers you to predict the date that is 730 days (or…

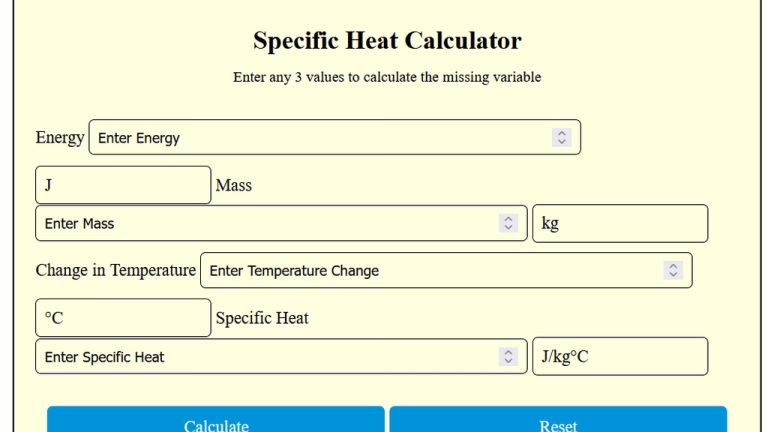

To find the specific heat capacity, divide the heat energy by the product of mass and temperature change. The Specific Heat Calculator calculates the specific heat capacity (c) of a substance. Specific heat is the amount of heat energy required to raise the temperature of a unit mass of a substance by one degree Celsius….

![Ml To Grams Calculator [Milliliters to Grams Converter 2025] 4 Alt text: MI to grams calculator interface with colorful buttons and math formulas for converting grams to milliliters.](https://areacalculators.com/wp-content/uploads/2025/07/ml-to-grams-calculator-768x432.webp)

To convert milliliters (ml) to grams (g), multiply the volume in ml by the substance’s density. The Ml to Grams Calculator is well-suited for converting milliliters to grams based on the density of a substance. Since 1 ml does not always equal 1 gram (except for water), this calculation is a basic requirement for cooking,…