Horizon Value Calculator

To calculate the horizon value (HV), divide the annual cash flow (ACF) by the difference between the required rate of return (RR) and the growth rate (GR).

The Horizon Value Calculator is a financial tool used to estimate the value of an investment or project at a specific future point, known as the horizon date. This calculation is crucial in discounted cash flow (DCF) models, as it accounts for the value beyond the forecast period. It is widely applied in stock valuation, corporate finance, and investment analysis.

Formula:

| Variable | Description | Unit |

|---|---|---|

| Horizon value | Currency (e.g., USD) | |

| Annual cash flow at the horizon date | Currency | |

| Required rate of return | Percentage (%) | |

| Perpetual growth rate | Percentage (%) |

Solved Calculations:

Example 1: Calculate Horizon Value for a Company

| Step | Value | Explanation |

|---|---|---|

| Annual Cash Flow () | Future annual cash flow | |

| Required Rate of Return () | Investor’s desired return rate | |

| Growth Rate () | Perpetual growth rate | |

| Calculation | Substitute into formula | |

| Result | Horizon value |

Example 2: Calculate Horizon Value with Different Parameters

| Step | Value | Explanation |

|---|---|---|

| Annual Cash Flow () | Future annual cash flow | |

| Required Rate of Return () | Investor’s desired return rate | |

| Growth Rate () | Perpetual growth rate | |

| Calculation | Substitute into formula | |

| Result | Horizon value |

What is the Horizon Value Calculator?

The Horizon Value Calculator is a specialized financial tool which is used to estimate the value of an investment or asset at a specific point in the future, typically beyond the projection period.

Often referred to as the terminal value, this concept is essential in discounted cash flow (DCF) analysis, helping investors and analysts gauge the long-term potential of an asset or business.

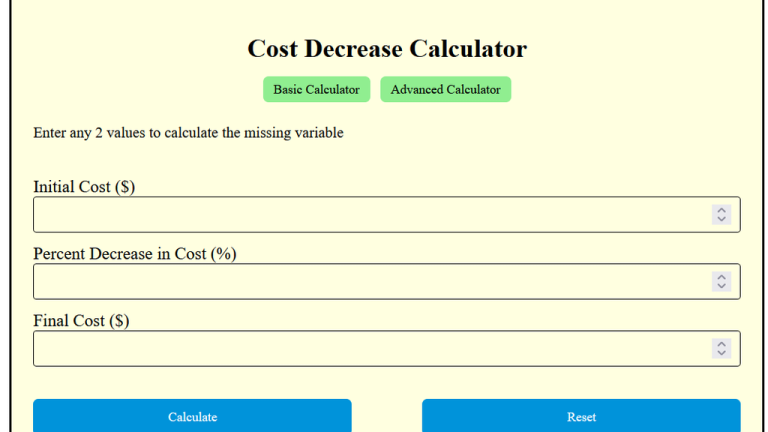

To use the calculator, input variables such as cash flows, growth rates, and the discount rate. The tool applies standard formulas like the perpetuity growth formula or the exit multiple approach to compute the horizon value.

For example, it can determine the future value of a stock or project using perpetuity growth assumptions or calculate terminal values for DCF analysis.

This calculator is beneficial for answering queries like how to calculate horizon value in Excel, understanding the horizon value of a stock, or exploring related concepts like intrinsic value and growth rates.

It is particularly useful in finance, where decisions rely on forecasting the value of investments over extended periods.

Whether you are assessing an investment, calculating terminal returns, or analyzing financial models, the Horizon Value Calculator simplifies complex computations, providing accurate and actionable results.

Final Words:

In essence, the Horizon Value Calculator is an indispensable resource for financial analysis. It enables users to forecast future asset values accurately, aiding in investment decisions and long-term planning.

![Absolute Uncertainty Calculator [ Uncertainty Calculator 2025 ] 1 Area calculators for precise measurement and uncertainty analysis, online area measurement tools for various shapes and units.](https://areacalculators.com/wp-content/uploads/2025/07/absolute-uncertainty-calculator-768x432.png)